SBF - The Regulator

After aggressively farming many of DeFi’s most lucrative opportunities since the summer of 2020, SBF is now suggesting his own industry standards, many of which go against the entire concept of decentralisation.

In a recent post on ftxpolicy.com, SBF laid out a “set of standards that we as an industry could enact to create clarity and protect customers while waiting for full federal regulatory regimes”

Sam says we need “customer protection”. But from who?

Let’s not forget that rekt.news has had to step in to protect FTX customers in the past.

We all know that SBF is a fan of “lobbying” the government, so we shouldn’t expect that these changes are only being proposed to the community. Parts of these rules are likely already in motion behind the scenes…

After making his riches in the wild west era of DeFi, is SBF trying to pull up the ladder and preserve his position, or is this simply the most effective way to be an altruist?

Whilst the article does mention points such as “code as speech” and non-policing validators, there are other ideas which threaten the whole concept of our decentralised industry.

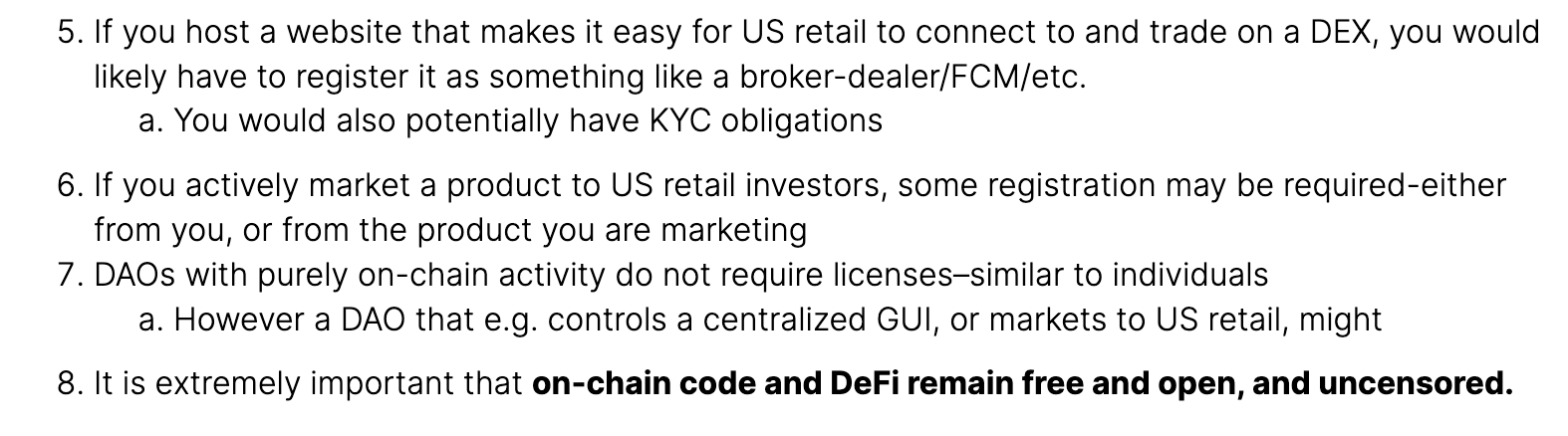

Amongst his thoughts on DeFi, is the idea that all front-ends would need to become registered broker-dealers with KYC obligations.

This would mean that, while publishing smart contracts and interacting with them directly would remain unrestricted, any UI or Dapp with a UI would need to register with US regulators and collect personal info on their US users.

Front-ends are the tools that the vast majority of users rely on to access DeFi protocols. Without them, SBF would not have been able to extract so much wealth from retail.

This industry is supposed to open the opportunities of finance to all, but under SBF’s vision it would only be truly open for those with the expertise to make direct contract calls, and TradFi for the rest.

Despite recognising DeFi as “crucial to a lot of the innovation that digital assets could ultimately bring”, he would rather stifle the growth of the industry as we know it.

Apparently believing that the writing’s on the wall for an industry which has avoided regulation for as long as possible, SBF looks to be positioning himself as the US Gov-approved gatekeeper to a watered-down version of the system from which he’s already profited so much.

SBF and Alameda have had deep enough pockets (and all the dirty tricks which they wouldn’t get away with in TradFi) to bleed many protocols dry throughout DeFi’s wild west period, and now they want to stifle innovation for the rest of us.

However, SBF has been clear that he’s not a crypto idealogue, he’s only in it for the money. And what could be more profitable than getting the government to kill your competition?

Considering the ~$40M he has already spent on lobbying this year, SBF has his sights set on not just being the only compliant one to survive, but also moulding the regulatory environment to suit FTXs own needs.

It would be shortsighted of him to let his dominant position slide…

A statement like this seems to be the best possible move one could make, as a businessman, in spite of potentially burning bridges with more ideologically minded DeFi advocates.

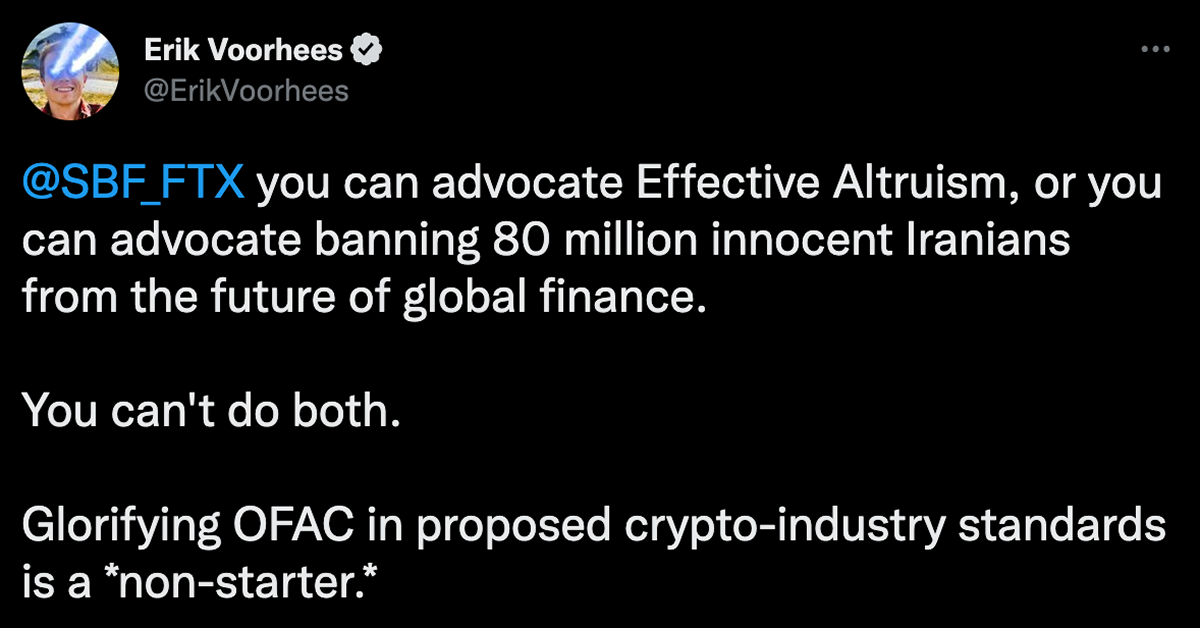

Amongst the many responses from his crypto colleagues, Erik Voorhees’ nuanced breakdown stands out. Taking the time to understand SBFs position, he agrees on many points, whilst also noting hypocrisy, the dangers the road to compliance presents, and the importance of maintaining DeFi’s core ethos.

But is this move SBF’s push to break out of the CT echo-chamber and establish himself amongst household names such as Elon and Bezos, or perhaps even running for office in the longer term?

Or is he himself being pushed, feeling the regulatory heat, and keen to have his say before the rules are made for him?

Those who have done well for themselves are consolidating their power, bringing CeFi towards DeFi, and handicapping their competition.

By stepping forward with these TradFi-friendly proposals, SBF is distancing himself from the typical crypto-baron image, plagued by lawsuits, journalists and scandal.

Before Andre Cronje supposedly left DeFi, he also stated that he would be focusing on regulation, having “launched multiple entities” to “provide, advise, and strategize on regulated crypto access.”

Careers in RegFi for those who’ve made it, demo-version DeFi for everyone else?

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Bulls Behind Bars

SBF is on trial and Su Zhu has been arrested in Singapore. Couple more arrests then up only? Washing out the apex-grifters presents an opportunity to return to crypto’s original ethos. Will we use it?

SBF - MASK OFF

SBF’s meltdown has gone from bad, to worse, to weird. The facade has fallen, and all his “beliefs” have turned out to be bullshit. The crypto movement is bigger than the failures of the past week, or at least, it will be...

FTX - Yikes

It’s all come crashing down for SBF, FTX and Alameda. Whether motivated by greed or altruism, the result is the same. The ends don’t justify the means - not when it ends like this.