Onyx Protocol - REKT

Another total fork-up.

Onyx Protocol, a Compound Finance fork, lost $2.1M on Tuesday to a high-profile, well-known vulnerability.

The exact same attack vector has hit two other forks, Hundred Finance and Midas Capital (themselves both repeat leaderboard entrants), already this year, tipping the total lost to this bug over the $10M mark.

Peckshield, as ever, warned Onyx to “take a look”. However, no official response came for almost three hours, when a team member acknowledged the loss.

In the meanwhile, and while TG mods were urging users “Please don’t fud” the protocol was hit by a repeat attack, though for substantially less profit ($~62k).

Many protocols have fallen victim to repeated exploits of identical vulnerabilities over the course of the year, with read-only reentrancy also claiming multiple victims including Conic, Sturdy, EraLend and Midas.

Are the devs paying attention?

Credit: Peckshield, BlockSec

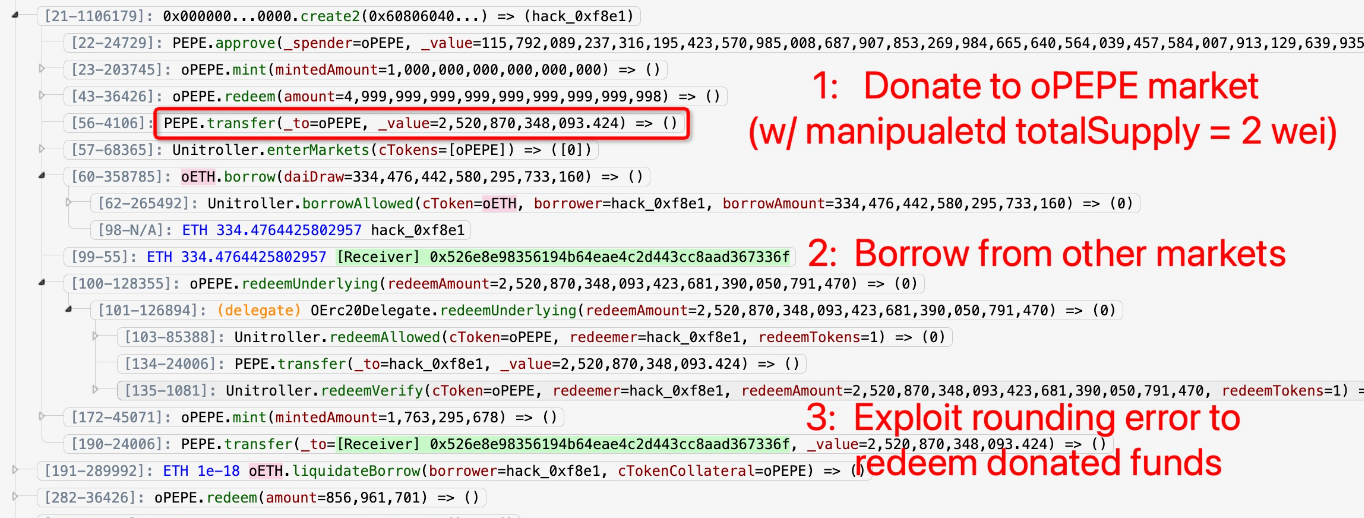

The exploit was made possible due to a known vulnerability of Compound v2 code. Under certain conditions, a rounding error allows an attacker to manipulate empty markets in order to drain liquidity from across the protocol.

In Onyx’ case, governance had recently voted through Proposal 22 to add a lending market for memecoin PEPE to the protocol.

The ‘empty market attack’ involves taking a flash loan which is swapped, in this case, for PEPE. Then, by minting a small number of shares (oPEPE) and donating a large amount of PEPE to the pool, vastly inflating the price of oPEPE for use as collateral on Onyx.

Other assets can then be borrowed against the overvalued oPEPE, draining the protocol’s liquidity. The rounding error is then exploited to withdraw the donated funds, and the flash loan is repaid.

Exploiter address: 0x085bdff2c522e8637d4154039db8746bb8642bff

Attack tx: 0xf7c21600…

Repeat exploiter address: 0x5083956303a145f70ba9f3d80c5e6cb5ac842706

Repeat-attack tx: 0x27a3788d…

The 1164 ETH ($2.1M) of profits were sent on to an intermediary address before 1140 ETH were deposited into Tornado Cash.

The remaining 24 ETH were sent to on-chain panhandlers, prompting a follow-up stream of input data messages to the hacker’s address, begging for further scraps.

Onyx Protocol was audited by Certik, however the viability of this vulnerability is ultimately determined by the conditions within the individual market, rather than the codebase in itself.

Empty markets in Comp v2 code are a known issue; the launch of new markets should be treated especially carefully by project teams.

The discussion following the (second) Hundred Finance hack references Hexagate’s recommendations for launching potentially vulnerable markets (“markets with low total supply and a non-zero collateral factor (CF)”):

we recommend any Compound V2 fork, when launching new markets to mint some cTokens and burn them to make sure the total supply never goes to zero. When the total supply goes to zero, the protocol becomes vulnerable and this strategy mitigates this situation.

That means that when listing a new collateral token, first set its collateral factor to zero, set in the Comptroller, mint some cTokens, burn them and then change the collateral factor to the desired factor.

Compound itself has many eyes scouring all governance proposals, though the occasional blunder does seem to slip through…

But with just 11 wallets voting on Proposal 22 (and over 97% of votes coming from a single address), perhaps Onyx doesn’t have the same level of community vigilance over its lending markets.

For teams working with forks, devs must be sure to stay on top of the security landscape, to avoid getting rekt by replicated vulnerabilities.

Blackhats are certainly keeping up-to-date.

Onyx’ proposed compensation plan intends to refund victims by selling native tokens from the treasury, while DAO contributors' salaries will be paused until further notice.

While superficially sounding like a fair and selfless way to make users whole, the plan has the potential to trigger a death sprial on XCN, whilst the team’s incentives grow increasingly misaligned…

What could go wrong?

REKT sert de plateforme publique pour des auteurs anonymes, nous déclinons toute responsabilité quant aux opinions ou contenus hébergés sur REKT.

faites un don (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

avertissement:

REKT n'est responsable en aucune manière du contenu publié sur notre site Web ou en lien avec nos Services, qu'il soit publié ou occasionné par l'Auteur Anon de notre site Web, ou par REKT. Bien que nous fournissions des règles pour la conduite et les publications de l'Auteur Anon, nous ne contrôlons pas et ne sommes pas responsables de ce que l'Auteur Anon publie, transmet ou partage sur notre site Web ou nos Services, et ne sommes pas responsables de tout contenu offensant, inapproprié, obscène, illégal ou autrement répréhensible que vous pourriez rencontrer sur notre site Web ou nos Services. REKT ne saurait être tenu responsable de la conduite, en ligne ou hors ligne, de tout utilisateur de notre site Web ou de nos services.

vous pourriez aussi aimer...

Onyx Protocol - Rekt II

Another Compound v2 fork that just can't catch a break, Onyx Protocol, has been exploited again. This time, the damage tally stands at a cool $3.8 million, siphoned off by the same high-profile vulnerability that bit them late last year.

Radiant Capital - Rekt II

Radiant Capital gets a $53M haircut. Thought multi-sigs were safe? Think again. Radiant's "robust" 3/11 setup crumbled like a house of cards. Exploited twice in 2024, the future of Radiant looks about as bright as a black hole.

Radiant Capital - REKT

2024 is off to a bright start... Lending protool Radiant Capital lost $4.5M, to a known bug. Keeping up with the security landscape is key, especially when dealing with forked code.