$FEW gets REKT

For those who have not seen the story, this was a short lived plan to hype up and pump the price of an airdropped token named $FEW, based on the “few understand” meme.

The project was an attempt to emulate the $MEME NFT farming protocol, which airdropped 355 tokens to 72 members of a Telegram group.

On September 22nd, at the $MEME all time high of $1962.68, this airdrop was worth $696,751.40.

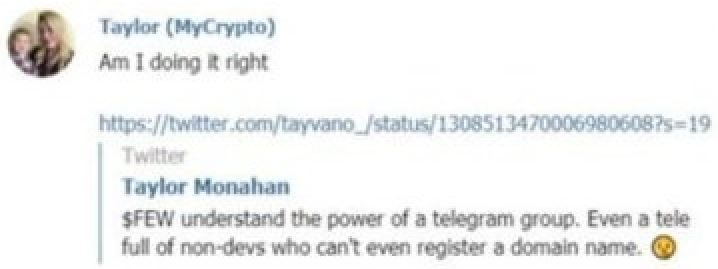

It’s easy to see why people who missed out would want to emulate this success, especially those who received the $MEME airdrop but sold too early…Despite the group members having no coding knowledge, no website, and no planned use case for the token, desire for the $FEW tokens built up quickly, and more well known names were added to the group.

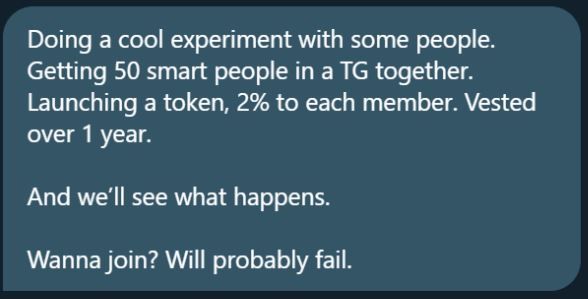

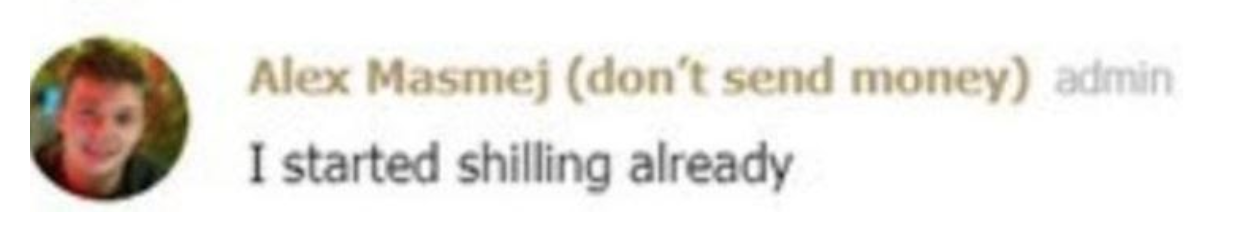

Co-founder Sam Ratnakar claimed that the goal was to gather 50 smart people and airdrop a token, but it seems the actual goal was to gather 50 well known people and use their influence to shill a token to those who didn't receive the airdrop.

The transactions can be found here. A further 13 received 10 $FEW each.

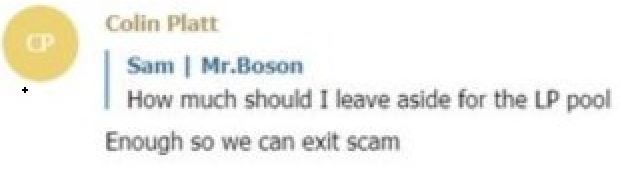

With 95.5% of the total supply airdropped to members of the Telegram group, it seems the remaining 4.5% was set aside to provide liquidity to a Uniswap Pool.

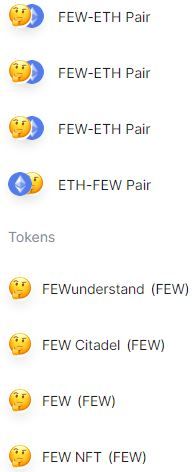

However, the chat screenshots went public before the pool could be opened, and the only $FEW pools on Uniswap are fakes.

The group's intentions were made public before $FEW started trading properly, preventing them from making any real profit.

11 $FEW holders have since burnt their tokens.There are more than enough screenshots of the conversation for anyone who wishes to read further into their true motives.

Anthony Sassano is the only person who has issued a full public apology since the incident. In his Twitter thread here, he goes on to apologise in full for his actions.

Bankless and The Block made no mention of the story.

Employee behaviour of this type doesn’t reflect well on any organisation, and the lack of any real self-investigation raises questions on whether their conflict of interest prevented them from wanting to report in more depth.

Those who have managed to position themselves as experts in their field have a certain responsibility to behave in a way that benefits the space. If not, what purpose do they serve?

It’s true not all names seen in the screenshots will have actively agreed to participate, but there are certain names that now have a lot of work to do if they wish to redeem any trust or reputation that they may have previously held.

We are living in increasingly uncertain financial times, and what might seem like a joke to some, could appear to be a genuine opportunity to others. Desperation can blind one's judgement, and we would all do well to remember, or imagine, what that feels like.

This story fits all too well with the increasingly prevalent arrogance and smugness of many crypto twitter users.

Too many anonymous accounts seem to enjoy pretending to be part of a secret boys club, adding no value to the space whilst enjoying the frustration of their followers when posting vague content implying they are privy to some secret knowledge that only “few understand”.REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.