Value DeFi - REKT 3

Twice in one week.

Value DeFi is a trainwreck.

Six months ago they lost $7M. Three days ago they lost $10M.

Now they’ve lost another $11M.

Brutal, savage, rekt.

The “co-founder” was a paid actress, the code was copied and used incorrectly, and as a result, Value DeFi has been absolutely taken down.

Is this the third and final time, or will the apes continue to forgive and forget?

What went so wrong with Value DeFi?

Approximately $11 million was stolen from the vSwap AMM vSwap pools.

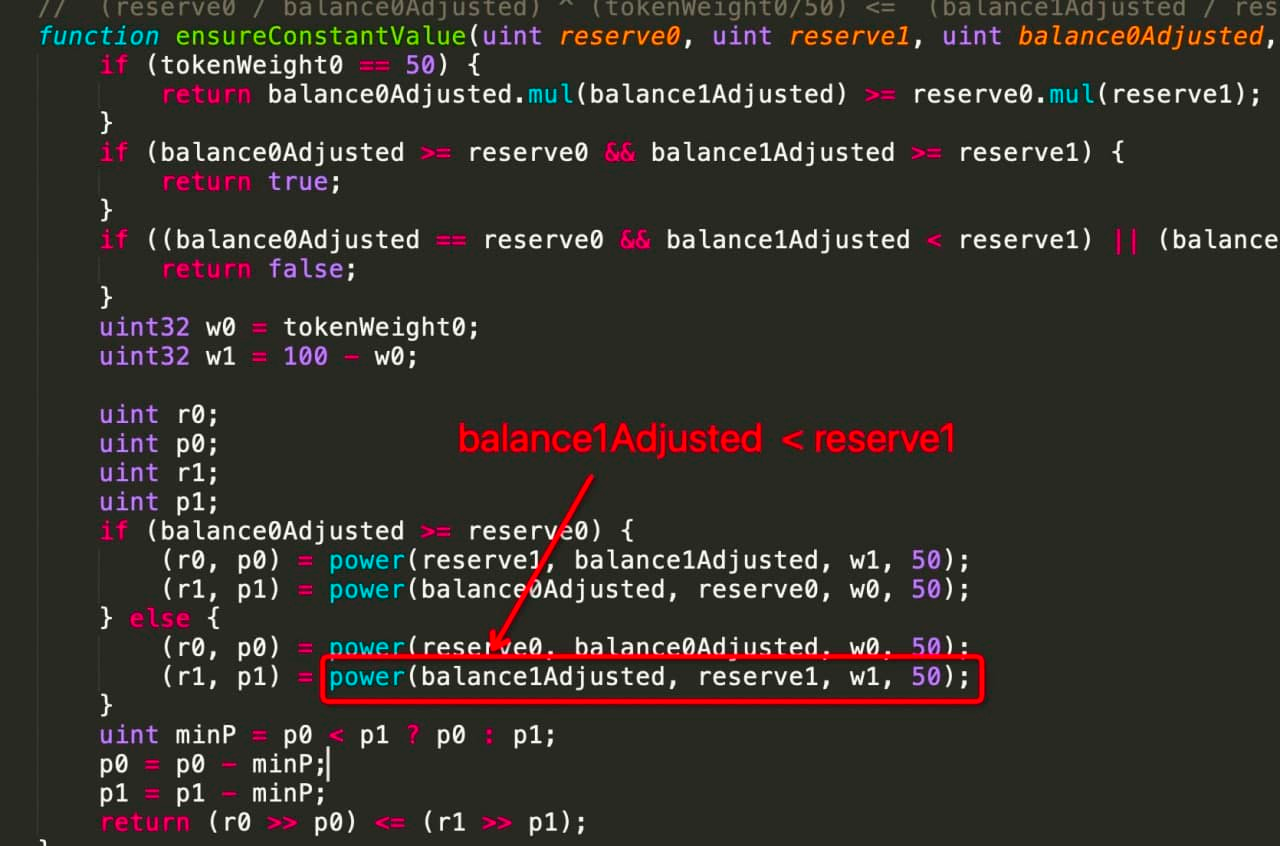

The incident was due to the improper use of a complex exponentiation power() function behind the calculation and enforcement of the weighted constant product invariant.

Any pool which did not have its liquidity split 50/50 between assets was exploited.

Since Uniswap only supports pools with a 50/50 asset ratio, Value DeFi used the Bancor formula for their non-standard pools.

Reference Transaction: 0x2fd0aaf0bad8e81d28d0ee6e4f4b5cbba693d7d0d063d1662653cdd2a135c2de

1. First of all, the attacker sends a small amount of a second token to pair addresses

2. They then make a swap in which they want to withdraw a small amount of the first token and a large amount of the second token.

3. Due to incorrect use of the Bancor formula, the pair contracts consider the swap to be successful. (root of exploit)

Stolen funds:

- 15k BNB

- 2.7k FARM

- 1.7k BASv2

- 8.5M BDO

- 68.3k BUSD

- 41.4k MDG

- 945k VBOND

- 1.2M BAC

- 11k FIRO

Credit: frankresearcher

Note the power() routine takes four arguments (baseN, baseD, expN, and expD) and is used to calculate an integer approximation of (baseN/baseD)^(expN/expD)*(2^precision) where precision is used for the calculated result. However, there is a caveat in how this power() function should be used. It makes an explicit assumption that baseN must be no less than baseD, i.e., baseN >= baseD. In this attack, the pool’s swap() function is called with a crafted input that intentionally violates the above assumption. As a result, the weighted constant product enforcement is passed while the pool funds are being drained.

Credit: peckshield

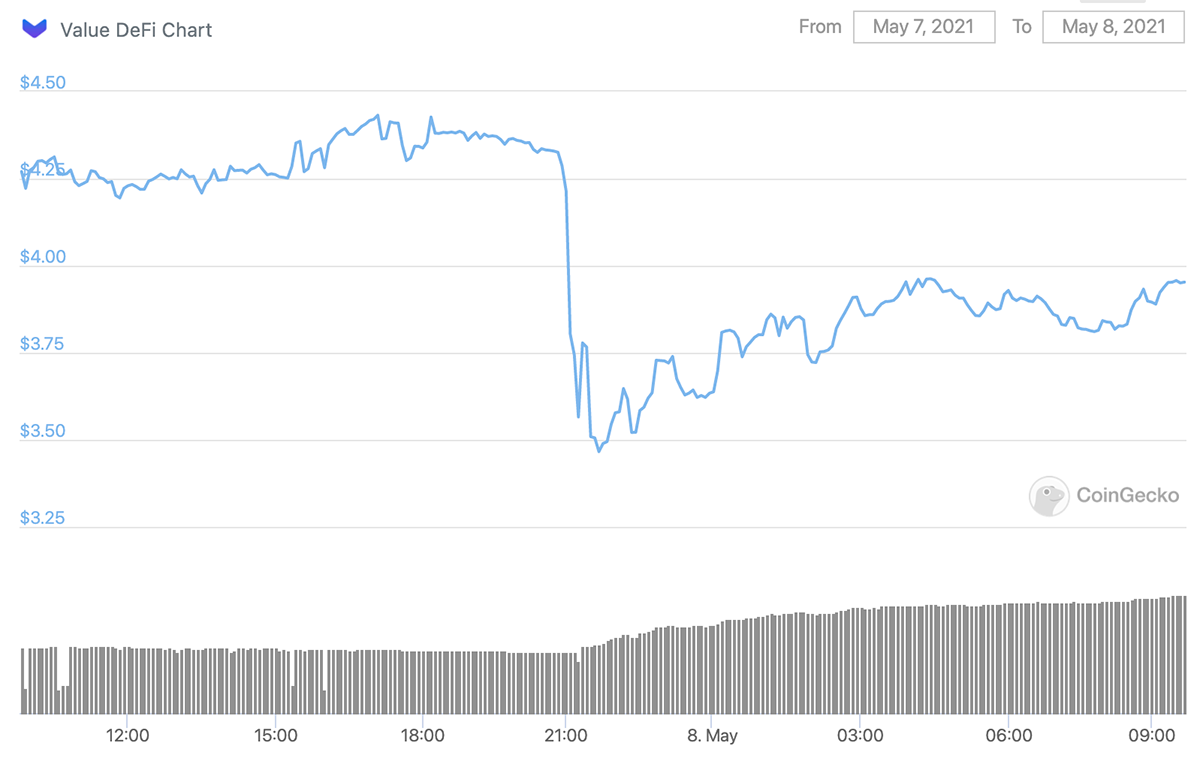

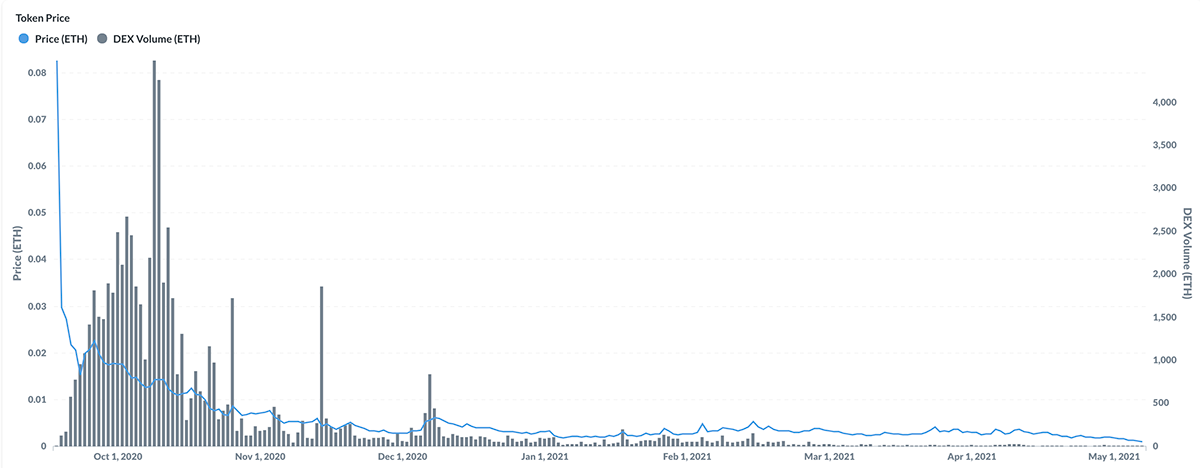

Despite achieving their third place on our leaderboard, the native token of Value DeFi has recovered somewhat since the latest exploit. However, Nansen shows us that the DEX volume has been decreasing consistently.

Will another rebrand save the most hacked protocol from losing all their users, or is this the end for Value DeFi?

The Value DeFi team were reassuring users of the safety of their platform only hours before the latest exploit, tweeting about increased security measures which clearly had zero impact.

Going forward, it’s hard to see how anyone could trust the anonymous developers, who admitted to using a paid actress on fiverr to play the role of their founder, and when they were confronted about it by a user, responded with something similar to;

The girl we caption as our co-founder in that video is actually just a paid actress, but one of our devs happened to go by that online alias, so then we coincidentally tracked down an actress by that same name on Fiverr to feature in our video!

Ape tax is high for users of Value DeFi, the least secure DeFi protocol. Who can have any sympathy for users of such blatant low quality projects?

We’re very thankful for all the new readers that Value DeFi has brought us over the recent months, but hopefully this will be the last time.

Although we ridicule the repetitive failures of the founders, these are not their funds that are being stolen. If they plan to continue their operations, then they will have to try much harder.

Instead of focusing on fake communications, focus on real users safety, not piling up worthless security audits.

Or maybe it’s time to call it quits and stop putting users funds at risk.

Can Value DeFi close their operations safely, or will we soon see a final exit scam?

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Value DeFi - REKT 2

2 for 1, that’s Value DeFi - The first protocol to feature twice on the rekt leaderboard. First seven million, and now ten million dollars taken, as Value DeFi gets rekt cross-chains.

Tapioca DAO - Rekt

Another day, another private key theft, another protocol rekt. Tapioca DAO on Arbitrum suffers a roughly $4.4 million loss in a private key compromise. Some funds have been recovered, though the full extent of the damage remains to be seen.

Radiant Capital - Rekt II

Radiant Capital gets a $53M haircut. Thought multi-sigs were safe? Think again. Radiant's "robust" 3/11 setup crumbled like a house of cards. Exploited twice in 2024, the future of Radiant looks about as bright as a black hole.