Sell The News

Wall Street credentials bought a lot of credibility - until they didn't.

Stuart Popejoy and Will Martino left JPMorgan in 2016 with a mission: build the proof-of-work blockchain that legacy finance couldn't.

Kadena promised 480,000 TPS through "braided" chains, institutional-grade infrastructure, and a Turing-incomplete smart contract language designed for safety.

November 2021 saw KDA hit $27.64 - briefly go over $3 billion in market cap while some on crypto Twitter crowned it the "Solana killer" at the time.

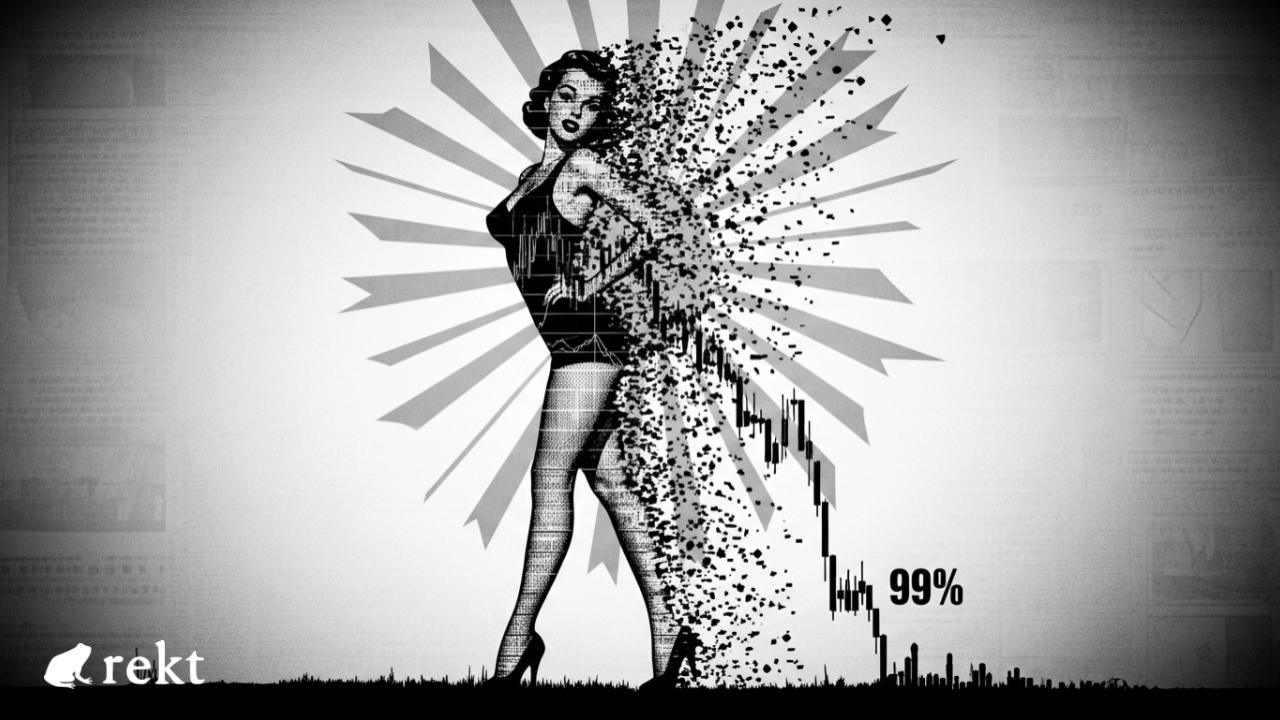

October 2025 brought a different story: three incidents in eleven days, including a foundation shutdown blamed on "market conditions," and a token trading at $0.06 - down 99% from its peak.

Between those dates sat $50 million in grant commitments, years of disputes with their partner Kaddex, and a hiring spree announced a year before pulling the plug.

Kadena didn't technically rug anyone - they just made sure to position themselves before delivering the obituary.

When your enterprise blockchain stumbles through a dozen days of chaos before shutting down, who’s really calling it institutional-grade?

Two former JPMorgan engineers built what they promised would be the future of institutional blockchain.

Popejoy spent 15 years building trading systems before leading JPMorgan's Blockchain Center of Excellence.

Martino worked as the tech lead for the SEC's Cryptocurrency Steering Committee before becoming chief engineer on JPMorgan's Juno blockchain - the precursor to JPM Coin.

Former colleagues who understood both traditional finance's needs and crypto's promise.

Proof-of-work that improves upon Bitcoin’s design by enabling infinite scaling without compromising security or efficiency. That was the pitch.

Chainweb would braid 20 parallel chains mining cooperatively - claiming it could scale to more than 50,000 chains.

Pact, their Turing-incomplete smart contract language, used formal verification to make contracts provably safe - a direct answer to the reentrancy bugs and unchecked logic that kept tearing holes in Ethereum.

“Kadena is the only blockchain capable of powering global finance.”

Kadena positioned itself as the backbone of Wall Street, selling a vision of enterprise-grade dominance.

$15 million raised across two funding rounds.

By mid-2022, Kadena hit its moment - Over $3 billion market cap at its peak, a flash of DeFi activity, and some dubbing it the Solana killer.

Then reality set in. Developer wallets went cold. Proof-of-stake chains drained all the attention and capital. The ecosystem stalled before it really began.

And yet, the announcements kept coming.

April 2022: $100 million grant program launched straight into bear market teeth.

Francesco Melpignano led Kadena Eco's initiative to support DeFi, NFTs, gaming, metaverse projects, and DAOs.

The ecosystem barely moved. TVL hit its high in mid-2022, but developers went quiet and grant money mostly sat on the sidelines.

2024 Kadena flickered briefly, thanks to a micro altseason in December - but was gone by January.

Later that same year, Annelise Osborn pitched a “hiring spree,” promising Kadena would claw back its market spot through aggressive expansion.

Mid-2025: another headline, the $50 million Grant Program, aimed at real-world assets and Chainweb EVM integration.

By the time Kadena shut down, $150 million had been committed to ecosystem growth.

Publicly known recipients numbered one - CurveBlock, which received $400,000 in June 2025.

KDA crashed 99% from its peak, dragging whatever treasury reserves existed down with it.

RealCyberDoctor put it plainly: "Kadena didn’t fail because the technology was bad, it failed because nobody outside the echo chamber cared enough to use it."

Token crashes, treasury collapses, operating costs exceed declining reserves, talent leaves, development slows, adoption stalls, token crashes further. Repeat until cessation.

But treasury death spirals don't usually produce three distinct incidents in eleven days - unless someone keeps selling into each wave of bad news.

When you promise expansion months before shutdown, are you delusional about runway or buying time to position yourself?

Pattern Recognition

May 2018: Emerging Markets Intrinsic organized executive meetings across Europe for Kadena.

The cost for the trip was 250,000 euros, EMI covered the costs of Kadena.

Result: 13 out of 14 qualified prospects secured. Contract terms were clear - hit milestones, earn 2.6 million KDA.

EMI delivered. Kadena's response, according to the lawsuit: they "never expected EMI to succeed" and "hadn't accounted for this in their financial modeling."

They needed to "play with the numbers" to figure out payment.

Litigation followed, with EMI alleging that Kadena hindered their efforts to secure qualified prospects and delayed press releases beyond agreed deadlines.

Pattern established: avoid financial commitments when costs exceed expectations.

Four years earlier, another dispute was brewing.

Kaddex - five legal entities scattered across the globe - hit WIPO with a UDRP complaint over the domain kaddex.com.

They claimed use of the "KADDEX" mark from 2019. WIPO panel dug into the evidence.

Domain registered April 14, 2021 by an Italian golf club. Used for a DEX on Kadena blockchain since June 2021.

Kaddex's trademark filing came October 14, 2021 - six months after domain registration.

But the real story was buried in the complaint details.

January 2021: Kaddex founder Michael Williams discussed plans for a DEX on Kadena via Telegram with Francesco Melpignano - a Kadena employee.

March 2021: Melpignano publicly announced that an "independent team" wanted to fork Kadena's code and launch a DEX called KADDEX.

The twist? Journalists later discovered Melpignano WAS the "independent team."

He registered kaddex.com through an Italian golf club connected to his family. Then used Kaddex's logo, designs, and business ideas to launch a competing DEX under an identical trademark.

A golf club with no crypto connections registering a DEX domain. A Kadena employee posing as an independent team while stealing a partner's identity and branding.

WIPO verdict 2023: complaint dismissed. "No convincing evidence" of prior use before the domain registration date.

The irony? This same Francesco Melpignano later became CEO of Kadena Eco, managing their $100 million grant program.

The guy who allegedly stole their DEX partner's identity was running their ecosystem funding.

Years of bad blood between Kadena and their biggest DEX partner, brewing since 2021.

But legal friction turns into something else when one party starts blocking infrastructure access while their token bleeds out.

What happens when your ecosystem partner becomes your executioner?

October’s Three Acts

October didn’t just arrive - it hit like a hammer.

Wave One: October 10

The crypto market faced its worst liquidation event in history - $19 billion wiped out across exchanges.

Bitcoin, Ethereum and altcoins took hits.

Trump's tariffs sent shockwaves through crypto markets, and Kadena was caught in the crossfire.

Kadena wasn’t spared. The KDA token plunged from $0.37 to $0.22 on that day and never quite recovered.

A single day of carnage - was it a warning, or the opening act?

Wave Two: October 14

Kaddex tweeted: "We will be shutting down all our kadena services including the rich list due to Kadena blocking our nodes from using reaching their bootstrap nodes. Will be moving to focus on Eth."

DEX partner publicly accused Kadena of infrastructure sabotage. Claimed node access blocked - no independent confirmation, no Kadena statement, just a public accusation.

Announced exodus to Ethereum. Zero warning. Four years after their WIPO legal battle, the relationship finally exploded in public.

But timing screams dysfunction. Seven days before Kadena's foundation shutdown.

When your biggest partner becomes your loudest critic, what’s left standing?

Wave Three: October 21

Kadena posted to Twitter: "We regret to announce that the Kadena organization is no longer able to continue business operations and will be ceasing all business activity and active maintenance of the Kadena blockchain immediately."

Immediately. Not next month. Not after a transition period. Immediately.

The KDA token spiraled from roughly $0.21 to under $0.09 in just under 2 hours - a wipeout of nearly $268 million in market value.

Trading volume exploded 1,277% as holders scrambled for the exits.

Initial confusion swept through. Was the account hacked? Discord confirmation crushed that hope. The team cited "unfavorable market conditions" as the reason.

The message mentioned a community governance transition and updates "as they become available." Small team retained for wind-down.

Blockchain "not owned or operated by company" - convenient legal distance from the wreckage.

Three sharp waves in 11 days. Each preceded by different information reaching different circles.

When your token crashes three times before anyone knows why, who's acting on what knowledge?

Revenge Tour

Kaddex didn't waste time. October 21-22 brought a tweet storm aimed straight at Kadena's corpse.

It got a little salty from the outset on October 21st: "We are pleased to have contributed to the failure of kadena. We stated from the start that not engaging the community and suppressing speech would have these effects. We will continue our litigation against kadena and their directors as the legal entities are dissolved."

Pleased. Not regretful, not sympathetic - pleased.

Next tweet: "If you are interested in joining our class action against Kadena, please comment below. We'll be reaching out individually to everyone who lost money due to the token decline and Kadena's directors' irresponsible behavior."

Then the explosive claim: "We have breaking reports that Kadena employees shorted KDA on several exchanges, including using leverage before the announcement making tens of millions in profit."

No proof provided. No exchange data. No wallet addresses. Just "breaking reports" sourced from nowhere.

Defamation or whistleblowing? Revenge or truth?

Four years of legal warfare culminating in unsubstantiated insider trading accusations while mobilizing a class action lawsuit.

Community response split between fury and resignation.

HuangBNB: "BREAKING: $KDA JUST EXIT SCAMMED. Kadena reportedly shut down. If you hold, consider exiting immediately before losses escalate."

Panic tweets lit the fuse on a selling frenzy.

ar.alpha summed it up best: “This wasn’t a shutdown; this was abandonment.

They left their investors, builders, and believers in the dark.”

He continued, “Kadena had everything - potential, technology, and community - but what it lacked was heart.”

“When things got hard, the team gave up. This wasn't the end of a project, it was the betrayal of a community. Kadena didn't die. It was abandoned."

Some held out hope for hack scenarios: "Do you think it is real or that the account has been hacked?"

Initial reactions swung between disbelief and flat-out denial - the shutdown landed too abruptly, too conveniently, and with timing that had every trader raising an eyebrow.

Maybe someone compromised the X account. Maybe this was a sophisticated phishing attack.

Discord became the verification channel. Team members confirmed authenticity there, crushing hopes fast.

No hack. No compromise. Just the actual team, actually shutting down, actually offering zero advance warning to holders.

Charles Hoskinson smelled opportunity: "Anyone from the Kadena ecosystem want to reach out?"

Cardano's founder offering refuge or poaching talent - depends on perspective.

Meanwhile, Kadena's official message mentioned community governance transition and updates "as they become available." Those updates have yet to come.

When your ex-partner celebrates your failure while accusing you of crimes they can't prove, who do you believe - the victim or the opportunist?

Chain of Suspicion

Three sharp waves. Eleven days. No single explanation fits clean.

Could there be a case for insider positioning?

Strategic silence from hiring spree to immediate shutdown. No gradual wind-down. No "we're struggling" transparency. Just straight to cessation.

The announcement was carefully worded to avoid liability. "Market conditions" served as force majeure defense. Blockchain "not owned or operated by the company" created legal distance from wreckage.

EMI lawsuit precedent showed a pattern: avoid financial commitments when costs exceed expectations. Management that reneges on obligations might position before delivering bad news.

Token-heavy compensation structure meant maximum incentive. If the team held KDA, they had every reason to exit early.

No public disclosure of executive holdings exists. Delaware LLC structure keeps ownership opaque.

Then there's October 10.

KDA didn’t escape the market-wide panic triggered by Trump’s 100% China tariff announcement.

The token dropped from $0.37 to $0.22 that day and never fully recovered - roughly a 40% decline.

Volume surged as holders scrambled for exits, but this was not an isolated collapse; the broader crypto market saw $19 billion liquidated across exchanges.

Reputational suicide looms large. Popejoy and Martino are public figures with Wallstreet backgrounds. Insider trading would have ended careers. SEC scrutiny would be catastrophic.

No smoking gun exists. No on-chain evidence of team wallet dumping. No SEC charges filed. No whistleblowers with documentation. Kaddex accusations remain unproven speculation for now…

October 10 matters - but not in isolation. It was a global market shock.

KDA’s continued weakness afterward hints at structural problems far bigger than a single trading day. Yet that day set the stage.

Within days, friction with Kadena’s DEX partner, Kaddex, went public.

Node access disputes and sudden migration plans made headlines on October 14, signaling that cracks weren’t just market-driven - they were operational too.

By October 21, the official shutdown announcement landed, after most damage had already been done.

Exchanges responded swiftly: KDA will be delisted from OKX and Bybit shortly following the shutdown announcement, cementing the token’s collapse and signaling that the market had officially moved on.

Leading to some questions that need answers…

When was the shutdown decided? Management minutes, board resolutions, email trails?

Who knew when? Employee notification timing versus public announcement. Were major investors informed early? Did Binance Labs get advance notice?

What did executive wallets do? On-chain analysis of founder addresses. Selling patterns weeks before announcement. CEX deposit activity.

Where did the treasury go?

Why announce a $50 million Grant mid-2025 if runway was months? Genuine initiative or distraction? Who approved allocating resources during the crisis?

What's locked in 83.7 million KDA vesting until November 2029? Team allocation? Investor schedules? Can these be clawed back?

The team mentioned they “are ready to engage with the Kadena community to discuss how we can aid the transition to community governance and maintenance.”

Will they actually follow through?

The most likely scenario sits between incompetence and calculation.

Not FTX-level fraud. Not Luna's algorithmic collapse.

Just treasury depletion, questionable messaging, and suspicious timing.

The following are speculative scenarios:

Q4 2024: the team figures out the runway’s almost gone.

Early 2025: last-ditch moves - hiring sprees, flashy grant announcements - trying to buy time or confidence, maybe both.

Mid-2025: treasury reality bites. Funds can’t stretch past Q3.

September‑October: the shutdown decision quietly lands.

October 10: amid the largest crypto market liquidation in history, KDA crashed alongside Bitcoin and altcoins, never fully recovering in the days after.

October 14: Kaddex sees writing on wall, exits publicly.

October 21: official announcement after most of the damage was done.

Mismanagement, not malice. Opacity, not fraud. Self-preservation, not theft.

But three incidents in eleven days before anyone knows why doesn't happen by accident.

When the blockchain remembers every transaction but founders forget to mention they're shutting down until 11 PM on a Tuesday, what exactly were they remembering to do first?

JPMorgan credentials opened doors that technology alone never could.

Stuart Popejoy and Will Martino built functional infrastructure - Chainweb worked, Pact delivered formal verification, the blockchain still runs without them.

They raised legitimate funding, secured real backing from Binance Labs, and attracted developers who believed the institutional-grade pitch.

None of it mattered because belief doesn't pay bills when your treasury holds tokens worth $0.09 instead of $28.

October 2025 delivered the math that 2021 hype couldn't solve: $15 million raised, $150 million promised in grants, and a token that crashed three times in eleven days before anyone knew shutdown was coming.

Kadena didn't technically rug anyone - no mint functions, no liquidity pulls, no Tornado Cash withdrawals.

They just chose opacity over honesty, self-preservation over community stewardship, and "market conditions" over accountability.

The blockchain continues. Miners still secure blocks. 566 million KDA remains to be distributed through 2139 - a 114-year emission schedule for a project whose leadership lasted nine.

Wall Street pedigree bought credibility but couldn't buy commitment.

When your institutional blockchain dies from institutional neglect, who's really being decentralized - the network or the responsibility?

REKT, anonim yazarlar için halka açık bir platform olarak hizmet eder, REKT'te bulunan görüşler veya içerik için hiçbir sorumluluk kabul etmiyoruz.

bağış yap (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

sorumluluk reddi:

REKT, Web Sitemizde veya hizmetlerimizle bağlantılı olarak web sitemizin ANON yazarı veya REKT tarafından gönderilen, yayınlanan veya neden olunan hiçbir içerikten hiçbir şekilde sorumlu veya yükümlü değildir. Anon yazarın davranışları ve gönderileri için kurallar sağlamamıza rağmen, onun web sitemizde veya hizmetlerimizde yayınladığı, ilettiği veya paylaştığı şeylerden sorumlu değiliz veya web sitemizde ve hizmetlerimizde karşılaşabileceğiniz herhangi bir saldırgan, uygunsuz, müstehcen, yasa dışı veya başka şekilde sakıncalı olan içerikten sorumlu değiliz. REKT, Web Sitemizin veya Hizmetlerimizin herhangi bir kullanıcısının çevrimiçi veya çevrimdışı davranışlarından sorumlu değildir.