House Of Cards

Backing a stablecoin with another stablecoin that's backed by the first stablecoin isn't revolutionary finance - it's just expensive performance art.

Stream Finance (xUSD) and Elixir Network (deUSD) built a perpetual motion machine: mint deUSD, borrow against it, mint xUSD, borrow against that, bridge it, loop it, call it "institutional-grade returns."

The same $1.9 million allegedly minted $14.5 million in xUSD - math that would make Terra blush, wrapped in the language of "market-neutral strategies" and "delta-neutral positions."

October 2025 brought receipts: transaction hashes, wallet flows, and Hyperithm - a sophisticated yield manager - quietly removing ALL exposure to the ecosystem before walking away with $10 million in user funds.

While retail chased 95% APY, the smart money was already calculating exit routes.

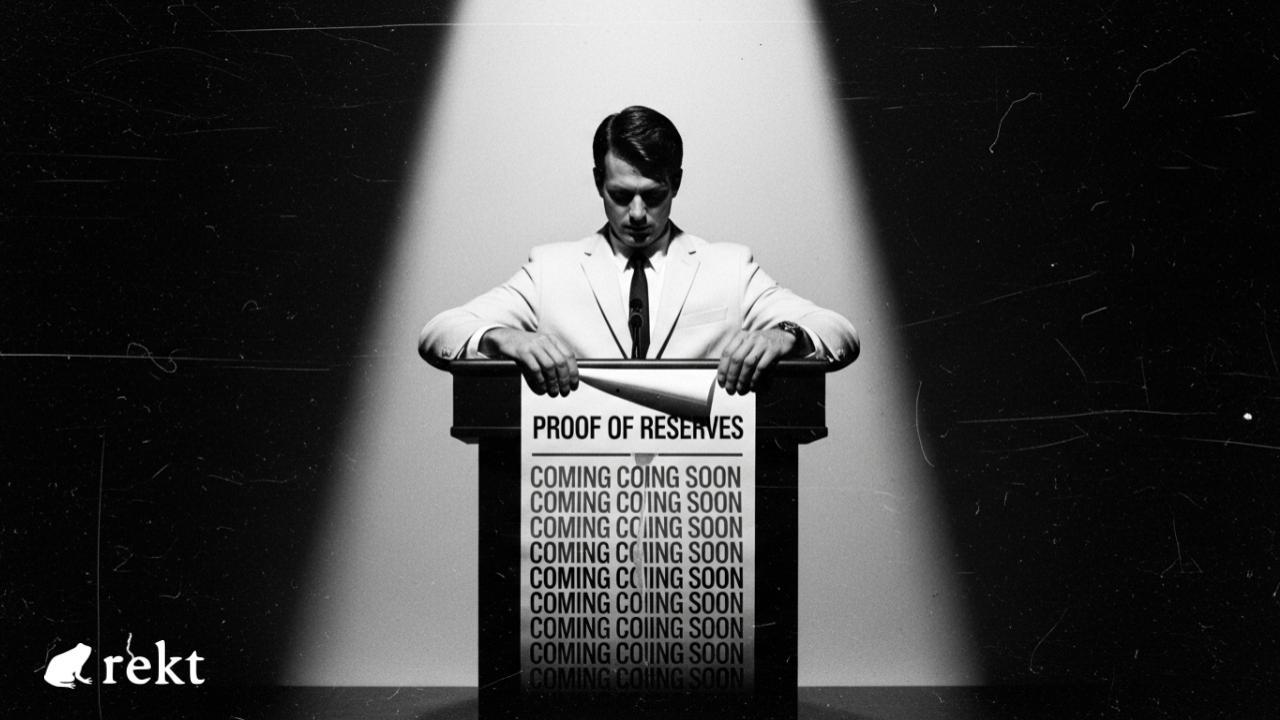

When your "stable" asset requires an insurance fund, proof of reserves - coming soon, and institutions evacuating in the middle of the night - what exactly is staying stable?

Stream Finance didn't show up in a hoodie promising moon missions.

They spoke the language of JPMorgan trading desks: "market-neutral fund," "lending arbitrages," "hedged top of book market making."

Elixir Network positioned deUSD as "DeFi's only dollar serving as rails for institutional assets" - backed by staked Ethereum and U.S. Treasury bills, partnered with BlackRock's BUIDL fund and Hamilton Lane. Both protocols wore legitimacy like armor.

Stream offers "market neutral strategies to earn high yield" via "lending arbitrages to incentive farming."

Elixir delivers yield on a supposedly stable asset via perpetual funding rate arbitrage.

Stack them together, and retail saw a golden ticket - institutional returns without institutional barriers.

Delta-neutral positioning. Fully collateralized. Transparent. Safe.

Legitimacy theater works best when nobody checks the stage props.

Stream retained direct minting control over xUSD through its StreamVault contract, while Elixir held the keys to deUSD's backing mechanism.

Both promised transparency - Stream's proof of reserves is perpetually "coming soon," while Elixir's documentation carefully noted that deUSD "is not pegged to USD through a 1:1 reserve", and “there is no centralized issuer holding real-world assets to support it.

Nobody reading the fine print noticed they were being sold a perpetual motion machine.

But how do you actually build a money printer that looks institutional enough to fool the institutions?

The Loop

On October 28, Schlag started exposing the recursive minting loop.

Which goes as follows…

USDC lands in Stream's xUSD wallet - users depositing into what they believe is a conservative yield vault.

What happens next is either genius or fraud, depending on whether you're doing it or getting done by it.

Schlag traced the looping fund flow as follows. The transactions are embedded below.

Step One: The Swap Dance

Stream transfers the USDC to a secondary wallet, places a CoW swap order to buy USDT, then mints deUSD from Elixir's on-chain minter.

The deUSD flows back to Stream's main wallet. Normal DeFi choreography so far - you've got collateral, you've got tokens, nobody's suspicious.

Step Two: The Leverage Spiral

Bridge that deUSD to Avalanche or World Chain - anywhere with sdeUSD lending markets.

Borrow stablecoins against your deUSD collateral. Swap those borrowed stables back to USDC.

Bridge back to mainnet. Rinse. Repeat.

October 28 saw three rounds, minting roughly $10 million in deUSD from the original capital.

Degenerate? Sure.

Scammy? Not yet - Aave sees this kind of leverage looping every day. Users chasing yield, protocols providing liquidity, leverage multiplying returns.

Standard operating procedure in DeFi's casino economy.

Step Three: The Recursive Twist

Here's where normal becomes nauseating.

Most leverage loops end with collateral sitting idle, earning yield.

Stream's loop ended with minting. With the final borrowed USDC, Stream minted xUSD - their own token.

The same $1.9 million in USDC allegedly spawned $14.5 million in xUSD.

Whether it’s leveraged yield or recursive leverage, the result looks less like finance and more like alchemy.

According to Schlag’s research, if Stream controls 60% of xUSD's circulating supply - a claim that remains unverified but looks increasingly plausible given the token's price behavior and anemic trading volume - then according to Schlag’s findings, each xUSD token is backed by roughly $0.40 of actual collateral.

Possibly sub $0.10, according to Schlag, if you're measuring direct backing across the entire system rather than playing accounting games with protocol-owned liquidity.

Step Four: The Circle Closes

But here's the beautiful part, the part that elevates this from garden-variety degenerate farming to something approaching art: who lends millions in stables against a token the protocol just conjured from thin air?

That would be Elixir, with $10 million in freshly acquired USDT.

Transfer that USDT to what their "Transparency Dashboard" labels "Elixir's sUSDS Multisig" - a name that would be funny if it wasn't holding eight figures.

Swap some USDT to USDC via CoW Protocol.

Elixir, across multiple transactions, moved $10 million in USDT.

Transfer USDT to what their "Transparency Dashboard" labels "Elixir's sUSDS Multisig" - a name that would be funny if it wasn't holding eight figures.

Swap USDT to USDC via CoW Protocol.

Bridge to Plume network. Supply that USDC directly to a Morpho lending market that accepts xUSD as collateral.

The process was repeated several times.

This market doesn't appear on standard Morpho UIs, according to Schlag.

Permissionless markets mean anyone can create isolated lending pools with custom parameters.

According to the allegations: $70 million USDC supplied, and over $65 million borrowed. Elixir was the sole depositor.

Stream borrows against its brand-new xUSD.

Bridge back to mainnet. Start again.

USDC becomes deUSD. Borrow USDC against deUSD. Mint xUSD with that USDC.

Borrow more USDC against xUSD through the Morpho market. Use that borrowed USDC to mint more deUSD. Loop closes.

Stream and Elixir aren't backing stablecoins - they're playing musical chairs with the same USDC pile while marketing it as two separate dollar-pegged assets.

The music keeps playing as long as nobody asks to redeem all at once.

Three rounds in a single day. Ten million in deUSD minted. Over fourteen million in xUSD created from less than two million in actual capital.

Transaction hashes sitting on-chain for anyone curious enough to look.

So who was looking?

The Warning Signs

October 28, CBB - a crypto KOL with enough clout to move markets - issued warnings that should have emptied some vaults: "If you have money on Morpho or Euler, withdraw from vaults with mHYPER and xUSD exposure. This is max opacity finance. The level of leverage from xUSD is insanity."

Red flags weren't just waving - they were on fire.

xUSD trades between $1.20 to $1.29, consistently above its supposed dollar peg.

Constrained supply could scream manipulation.

deUSD daily trading volume regularly falls below $100K - anemic liquidity for a $160 million "stablecoin." Price instability, volume death, and nobody asking why.

May 2025 delivered the technical failure that should have ended everything: a Chainlink oracle malfunction caused over $500,000 in liquidations for deUSD users on Avalanche's Euler Finance.

Oracle failures aren't bugs - they're features of systems built on shaky foundations.

deUSD hit an all-time low of $0.9831 in August, a 1.7% de-peg that sounds small until you remember stablecoins trade on the assumption they won't depeg at all.

August 2025 brought a delisting.

Inverse Finance's community voted to sunset deUSD markets entirely, citing "risk and operational concerns."

When DeFi protocols start refusing your collateral, that's not market volatility - that's reputation damage.

Retail kept depositing. Warnings accumulated like unpaid debt, ignored until the bill came due.

But warnings only matter if someone with credibility starts acting on them - so what happens when that someone manages $160 million and decides the math doesn't work anymore?

The Contagion

YieldFi's yUSD was holding the bag while everyone watched Stream and Elixir's recursive theater.

October 26: Analyst Togbe starts connecting dots.

YieldFi's largest positions are deposits in a Morpho Vault named ABRC.

Their largest supply position: the yUSD/USDC market on Morpho, where borrowers were leveraging yUSD across multiple lending platforms.

Their second-largest position: mHYPER, yielding negative returns. YieldFi represented over 10% of mHYPER's total value locked.

On Arbitrum, mHYPER lent against yUSD.

mHYPER's second-largest allocation: Stream's xUSD.

The web looked elegant on paper:

Stream mints xUSD, Elixir mints deUSD, both flow into Morpho and Euler lending markets.

YieldFi's yUSD borrows from those markets while simultaneously serving as collateral for mHYPER.

mHYPER lends back into the same ecosystem, creating a closed loop where every protocol's solvency depends on every other protocol's solvency.

Bootstrapping liquidity through circular dependencies works great until one link breaks.

Maybe just users reading on-chain data and deciding they didn't want to be the last one holding the bag.

24% of yUSD's market cap vanished in twenty-four hours while the team stayed silent.

October 28, 2025: Hyperithm made it official.

Hyperithm manages mHYPER - a market-neutral vault run by Forbes 30 Under 30 founders operating out of Tokyo and Seoul.

Institutional-grade reputation, sophisticated strategies, the kind of operation that doesn't panic over Twitter rumors.

Their announcement read like a corporate press release: "We appreciate the feedback and would like to provide full transparency on the situation."

Translation: we've done the math, and we're out.

Actions taken: removed ALL yUSD exposure, removed ALL xUSD exposure, deploying dedicated non-recursive lending vaults on Morpho and Euler, full liquidity migration expected by next week.

They held $10 million in unleveraged mHYPER positions as GP commitment - proof they weren't running, just repositioning away from systemic risk.

Hyperithm even provided wallet addresses for transparency:

0x7C1d52A3459f2Eee78DA551b8C3D13FdF61fbc93

0xEa036F911b312BC0E98131016D243C745d14D816

Anyone could verify their holdings, their moves, their timing.

Sophisticated institutions don't exit opportunities because they're risk-averse.

They exit because they've stress-tested the scenario where borrowing costs spike, liquidity dries up, and the loop stops being profitable.

When that happens, forced unwinding cascades through every protocol simultaneously.

Liquidations trigger more liquidations. Collateral gets dumped. Markets that looked isolated suddenly reveal their interconnections?

Morpho's permissionless market structure meant hidden exposure everywhere.

Euler Finance, already scared from May's oracle incident, sat exposed to multiple tokens in this web.

Curated vaults had layered risk - lending against xUSD, which was backed by deUSD, which was collateralizing yUSD, which was funding mHYPER, which was lending back into the same markets.

Retail depositors in those vaults had no idea they were three degrees of separation from a recursive mint loop that could collapse the moment interest rates shifted or one protocol faced a redemption wave.

Hyperithm knew. They pulled $10 million and documented every step.

But knowing isn't the same as preventing - so what did the architects of this system have to say when the dominoes started tipping?

The Defenses

DCF God weighed in on the situation.

The crypto investor disclosed his stake in Klyra which owns part of Stream, no pretense about his conflicts. His take: xUSD is degenerate, but not unbacked.

His logic went like this: if there's a token paying X APR and you can loop against it at 0.5X APR, you should do that all day.”

His logic: "if there is a token paying out x Apr and they can loop against it at 0.5x Apr then they should do that all day. Even if they can at 0.95x because they are farming points and perhaps even have a side deal for more tokens."

The economic case for aggressive looping: "If the curators or other lenders are willing to lend 10M of usdc against xusd, they can inhale all 10M with just 2M of deposits, and use the 10M to farm at much higher than their cost to borrow."

"It's not a game to get the best looking external metrics. But it is a game to get the highest possible yields for the business and vault depositors."

Capital efficiency. Yield maximization. The language of finance applied to what's essentially leveraged gambling on tokens you control.

"Risky levered degenerate potential for complete losses? Yes. Scam, not backed? No."

DCF God admitted: "I've never advised anyone to deposit in xusd (nor would I), but we are for a small piece of the port because the farm is good... we're not just invested here but actually deposited so its different."

Different when you're deposited versus just talking about it, apparently.

"In the case of our personal farms, we mostly stop looping at 5x because we're far too lazy to deal with the bs from rates changing, times to withdraw, unlooping, etc."

But for Stream? "that's their business - it's the most degen farm. If you're deposited there, that's what you should expect them to do."

His philosophy on leverage: "if you're gonna be degen, you might as well be full degen... whats the diff if you're at 80% ltv or 90% ltv... if the underlying gets rekt, you're liquidated... so might as well juice all you can."

Stream's team had their own version of risk management.

Stream's response came from 0xlaw on October 28: The team claimed a $10 million insurance fund.

Everything external to the main wallet operated with "0 leverage involved and fully liquid immediately."

They claimed to have protected user assets while managing protocol-owned leverage, and had never been exposed to a liquidation or an exploit.

Proof of reserves coming soon. Working with third-party providers for 24-hour updates. Scaling happened fast enough that publicly displaying positions would dilute their edge.

Then came the defensive pivot: "Due to how some Twitter users are feeling regarding protocol owned liquidity holding levered positions - this has been transparent from day 1 - we will wind these positions down and cap them at a size based off insurance fund size."

Protocol-owned liquidity holding leveraged positions was apparently transparent from day one.

Funny how transparency looks different when sophisticated managers start exiting and investigators start posting transaction hashes.

Stream promised to wind down the exact positions being criticized while insisting everything was fine.

Read that again.

They're unwinding the leverage they claim was never a problem. Capping positions they say were always transparent. Publishing proof of reserves they insist already exist.

That's not a defense - that's a confession wrapped in a press release.

"Coming soon" became the refrain. Insurance fund composition? Coming soon. Reserve verification? Coming soon. CEX insurance policies they claimed to purchase? Coming soon.

Actual proof beyond tweets? Coming soon.

Safety theater doesn't survive stress tests.[

DCF God pointed to the XPL premarket liquidations as proof - traders who maintained 2x overcollateralization got liquidated hardest when the system broke, despite being the "safest" positions on paper.

Extra collateral didn't save them when the underlying assumptions failed.

The lesson: when systemic risk materializes, conservative positioning inside a broken system just means you lose more slowly.

DCF God called xUSD degenerate.

Stream admitted they'd wind down protocol-owned leverage.

Neither claimed the recursive minting wasn't happening - they just argued about whether it mattered.

If the loop is legitimate yield farming rather than systemic fraud, why did the price action and exit patterns look so much like the beginning of a collapse?

Stream and Elixir built functional protocols. Smart contracts executed perfectly. The loop worked exactly as designed.

The difference between innovation and fraud isn't always in the code - it's in what you choose to disclose.

Protocol-controlled supply allegedly at 60%. Recursive minting that turned $1.9 million into $14 million in tokens. Proof of reserves perpetually "coming soon."

Calling it institutional-grade isn't marketing - it's malpractice.

They might be printing yield today, but gravity always catches up to anyone pretending it doesn’t exist.

Hyperithm read the on-chain data, saw the writing on the wall and removed $10 million.

Most depositors didn't have that option because they didn't know they needed it.

DeFi promised trustless systems.

Stream and Elixir proved you don't need to eliminate trust - you just need to eliminate disclosure until the smart money has already repositioned.

When stability depends on nobody asking questions, what are you really building - a protocol or performance art?

REKT, anonim yazarlar için halka açık bir platform olarak hizmet eder, REKT'te bulunan görüşler veya içerik için hiçbir sorumluluk kabul etmiyoruz.

bağış yap (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

sorumluluk reddi:

REKT, Web Sitemizde veya hizmetlerimizle bağlantılı olarak web sitemizin ANON yazarı veya REKT tarafından gönderilen, yayınlanan veya neden olunan hiçbir içerikten hiçbir şekilde sorumlu veya yükümlü değildir. Anon yazarın davranışları ve gönderileri için kurallar sağlamamıza rağmen, onun web sitemizde veya hizmetlerimizde yayınladığı, ilettiği veya paylaştığı şeylerden sorumlu değiliz veya web sitemizde ve hizmetlerimizde karşılaşabileceğiniz herhangi bir saldırgan, uygunsuz, müstehcen, yasa dışı veya başka şekilde sakıncalı olan içerikten sorumlu değiliz. REKT, Web Sitemizin veya Hizmetlerimizin herhangi bir kullanıcısının çevrimiçi veya çevrimdışı davranışlarından sorumlu değildir.