Monkey Business

In just one year, Bored Ape Yacht Club has evolved from a niche NFT, into a whole ecosystem, and a mainstream means of flexing wealth.

Staring blankly out from the Twitter timeline, Bored Apes have brought NFTs into the public eye, whilst making huge gains for all early collectors and traders.

The collection’s mint price was 0.08 ETH, (just $190 back in April 2021), but now, the cheapest ape will cost you at least ~$340k.

However, the relentless rise of BAYC has turned off many of the original Digital Art Enthusiasts, who feel that the project has been adopted by embarrassing scam-prone noobs and celebrities, and that the core team has ditched the most important values of crypto.

For many, the scandal surrounding the recent Otherdeeds mint has been the final straw.

Since the launch, APE, BAYC and OTHR are all down tremendously.

As confidence falters and loyalty wanes, what will the future bring for Bored Apes?

The initial success of Bored Apes can be attributed partly to timing; at the height of Shitcoin spring, as DeFi tokens were about to crash, Bored Apes arrived, and NFT summer began.

BAYC’s aesthetic and add-on accessories managed to capture a resonance with owners that mostly evaded their predecessors.

In fact, the project has totally eclipsed the CryptoPunks. First came the ‘flippening’ towards the end of last year, when the rising BAYC floor price surpassed that of Punks at around 60 ETH, and then the eventual acquisition of LarvaLabs by Yuga for an undisclosed amount in March.

However, success always attracts haters. There have been various attempts to cast shade on the project, whether they were a genuine concern or not is up to you to decide.

Remember when the team got doxxed?

Remember when apes were racist?

It’s safe to say that most of the NFT crowd isn’t “in it for the tech”

The never-ending accounts of BAYC owners falling victim to scams and “hacks” is well documented.

Monkey business pays well in ape season, but it’s the hunters who make the most profit.

Multiple methods have been used to separate Apes from their owners, ranging from verified Twitter accounts posting phishing links, to exploiting bugs in the OpenSea UI, BAYC Discord being compromised, and of course the recent Instagram hack which saw an estimated $2.4M lost.

There has been no shortage of scandal surrounding this project, but that didn’t stop it from going mainstream.

Snoop Dogg is just one of several celebrities who have aped in to the project, many of whom were assisted by the agency “Moonpay” who supply NFTs to celebrities, or is it the other way round?

Various celebrities have become involved with NFTs, and their reception is always polarised.

Bagholders rejoice, while onlookers cringe at the unnatural partnering of two brands that are fighting to keep your attention.

We can forgive anyone who doubts the authenticity of celebrity appearances in NFTs.

Yuga Labs and fans have continued to capitalise on BAYC’s success with spin-offs such as Bored Ape Kennel Club and Mutant Ape Yacht Club, even opening an IRL burger joint.

However, the ultimate monetisation strategy was inevitable.

ApeCoin, the Bored Ape currency, was launched and airdropped to all BAYC holders on March 16th.

With a staking programme that can be described as “paying people in ApeCoin to hold ApeCoin”, could it be that providing exit liquidity for the team is a key function of the ApeCoin tokenomics?

Maybe not... ApeCoin can be used to buy NFTs on OpenSea, and it will be the native currency of the much teased Bored Ape metaverse: “Otherside”, where fans will be able to purchase land (Otherdeeds) with ApeCoin.

The Otherdeeds mint came shortly after the launch of ApeCoin, as Yuga Labs were keen to provide some utility to the token.

The mint was wildly successful, but mainly for YugaLabs, and not really for anyone else.

The first red flags came before the launch.

Minting required users to KYC in advance before paying 305 APE (~$6k) as the mint price, ensuring a juicy pump to over $25 for $APE as prospective landowners bought in in anticipation.

Then, aside from the compulsory phishing scams, the launch crippled the Ethereum network for ~two hours. Gas prices soared, while users paid up 60,234 ETH ($170.8M) to mint the land NFTs, and 1,653 ETH ($4.7M) was lost purely on failed transactions.

YugaLabs have announced that they will refund all failed txs, although the scheme has, of course, turned into yet another a phishing target.

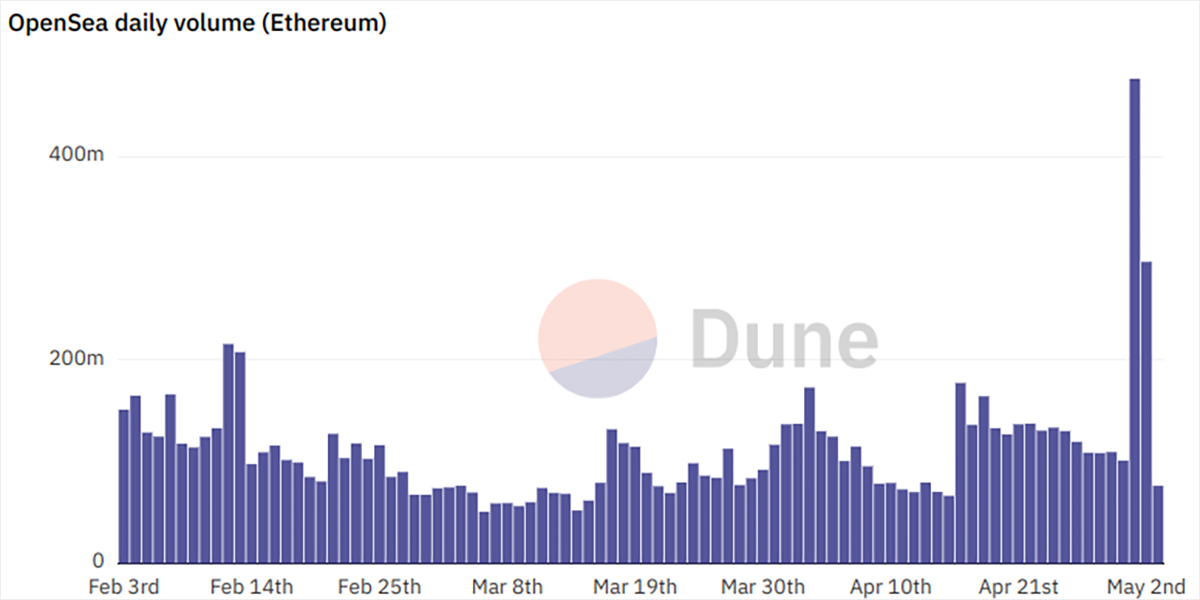

Aside from gas, the launch netted $320M in mint fees to Yuga, plus ~$475M in secondary sales, resulting in OpenSea’s highest ever daily volume.

All BAYC related products dropped in value after the launch.

Apecoin is currently down >40%, and Otherdeeds themselves are down over 50%.

YugaLabs’ response to the chaos was perceived as arrogant (“turning off the lights on Ethereum”), blaming “Ethereum’s bottleneck” and suggesting that the ape-verse moves to its own chain.

The statement was not well received, with some pointing out how the lack of the mint contract’s gas optimisation led to over 40k excess ETH (>$100M) burned.

Burning so much ETH might appeal to the bulls, but this just seems like a waste.

Aside from the bad OpSec stories from their holders, this has been the first indisputably negative PR event for the BAYC world.

With their steady flow of new product launches, Yuga Labs excels at maintaining the necessary hype around the BAYC ecosystem.

Will Ape-chain be their next solution? Probably, and who can blame them for taking that route?

A centralised layer one chain might be a better solution for them, (and their holders) and with so much money to spend, they’re in the position to build whatever they want.

Yuga is not a tech company, (as we saw by the mint), but they are excellent at what they do, and providing they can maintain the hype, their current focus on brand and marketing will surely lead to something more.

The Yuga revenue model is basically fuelling FOMO to sell hot air (or gas in the case of the recent launch) and it works very well for them.

But even masters of marketing can’t escape the Elon effect.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Treasure DAO - REKT

Swiggity swooty, somebody plundered the Treasure DAO booty. ~$1.4M worth of NFTs has been stolen from the largest NFT marketplace on Arbritrum, leaving the OpenSea competitor stranded in deep water.

JayPegs Automart - REKT

A blue-chip rekt by a front-end attack. Remind us, which part of crypto is supposed to be “trustless”? Misplaced faith (temporarily) cost MISO $3.1 million.

Banksy Pranksy Scam

The Banksy Pranksy Scam caught the attention of even the mainstream media, but nobody tried to find the truth. Was it a publicity stunt, or "performance art"? We stop and search the suspects to find out more.