Meter - REKT

Another attack sees $4.4M taken from Meter.io on BSC, making Hundred Finance lose $3.3M in collateral damage.

This is the 7th bridge attack on our leaderboard, showing a rising trend in cross-chain criminality.

How long will it take to perfect the tech and stop these losses?

The meter is running.

Credit: @ishwinder

The attack started at ~6am PST on February 5th, when the attacker maliciously minted a substantial amount of BNB and wETH tokens, draining the bridge reserve of its BNB and wETH before all bridge transactions could be halted by Meter.

Meter_io Passport is a fork of ChainSafe's ChainBridge, but with one change introduced to the deposit method of the ERC20 Handler.

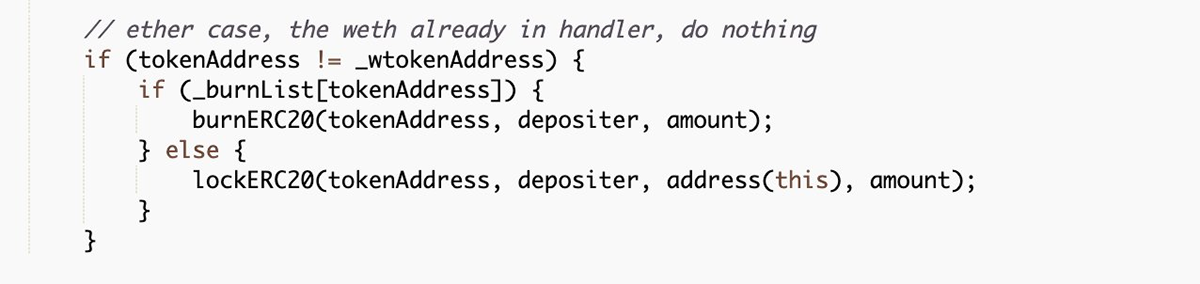

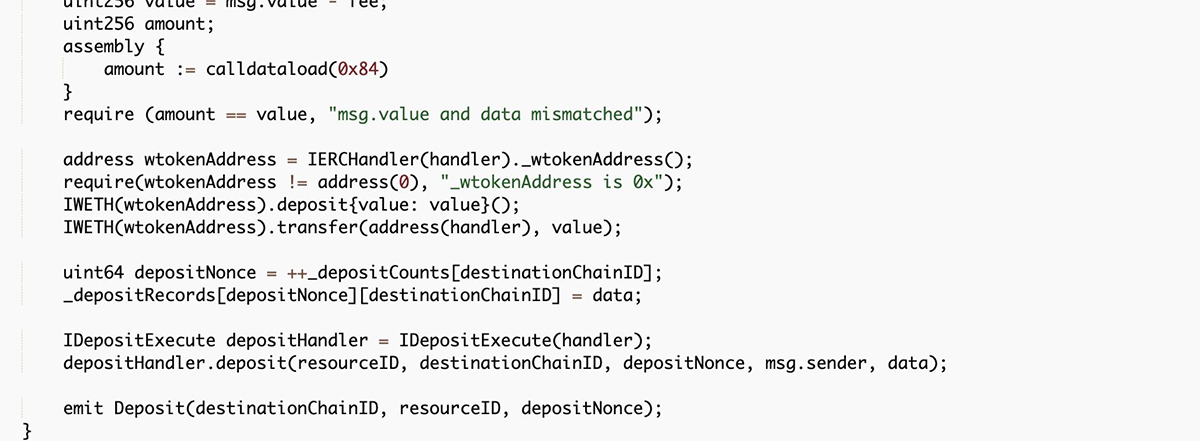

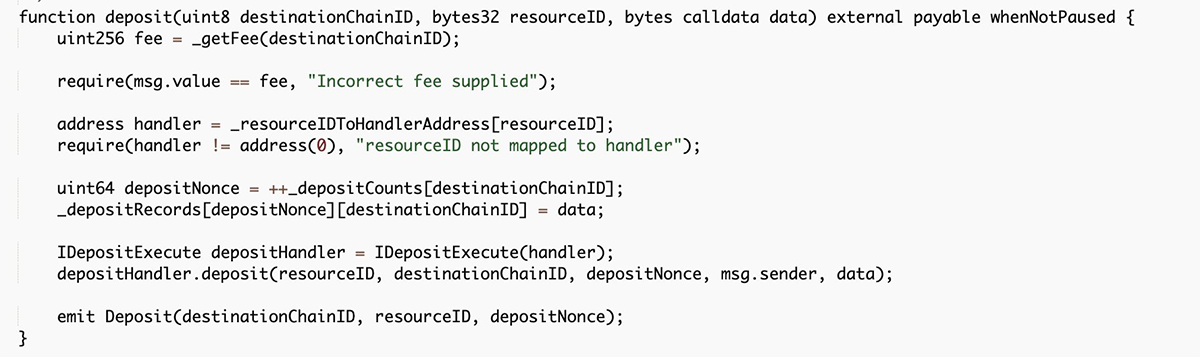

This change basically assumes that if the token being bridged is wrapped Native token then it doesn’t burn or lock since the wrapped Native token is already unwrapped and the amount transferred to the handler contract.

The assumption holds true for one of the deposit methods depositEth which also asserts the value of amount in calldata(which will then ultimately get passed to the handler's deposit method):

But the assumption doesn't hold true for another method deposit in the same contract which is mostly unguarded.

Hacker notices this and sends an arbitrary amount in the calldata, which gets passed on the handler's deposit.

The loot was then moved into Tornado Cash across multiple transactions over the space of one hour.

This attack created collateral damage.

Hundred Finance lost $3.3M due to their reliance on the Meter bridge.

Hundred announced the loss in a tweet.

Today Hundred Finance's @MoonriverNW deployment was affected by a bridge attack on @Meter_IO that resulted in the local depreciation in the price of BNB.bsc.

Accounts were able to purchase BNB.bsc at a reduced price and use these tokens as collateral at the global Chainlink price to borrow uncompromised assets on our platform. Of these, MIM and FRAX are currently impacted.

We would like to request that owners of the accounts that did so consider returning the assets borrowed so that other users are able to access their liquidity. 1 acc. holder has already done so and we are willing to pay further bounties to the remaining 3 for doing the same.

We spoke to the founder of Hundred Finance, vfat:

rekt:

Will Hundred Finance be making any changes following this incident? You mention you are working with Meter towards a possible resolution - could you provide any more details?

vfat:

Hello, so yes of course this is an issue we are all too aware of, each new chain / bridge we add has its own risks, and a lending protocol is a natural target for bridge attackers.

We used Meter as they were the main source of wrapped BTC on Moonriver, this combined with the native bridge and Multichain puts us at 3 bridges on that chain which is the maximum we would use. Going forward we will be stricter on this, and publish more detailed information about which bridges are used for which assets. We will also look into extra monitoring for possible attacks like this.

Meter have of course accepted responsibility for this hack and are intending to use their native token for reimbursement to the extent that they can, currently we are in the gathering addresses and amounts stage.

One interesting thing is that there were 4 opportunistic loans at Hundred in total, but the first 2 have been repaid, so there is some modicum of hope still for the other 2.

Current loss to Hundred users is $3.3M.

The voluntary repayments of the “opportunistic loans” taken on Hundred Finance are a rare sight to see, and it is commendable that Meter are accepting full responsibility for all losses.

Meter claim to have some evidence as to the identity of the hacker, and have stated they are working with authorities to bring justice.

However, on-chain crime rarely has off-chain consequences, and it won’t be long until we see another attack of this type.

There will be more bridge attacks, and more users will lose money, but eventually someone will succeed in building a safe bridge.

We are still too early to be risk-free, but that just means more opportunity.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Agave DAO, Hundred Finance - REKT

Two forks met the same fate. Agave DAO and Hundred Finance both fell victim to the same reentrancy attack. A combined total of $11.7M stolen. Considering the structure of DeFi today, the double damage is not surprising.

Tapioca DAO - Rekt

Another day, another private key theft, another protocol rekt. Tapioca DAO on Arbitrum suffers a roughly $4.4 million loss in a private key compromise. Some funds have been recovered, though the full extent of the damage remains to be seen.

Radiant Capital - Rekt II

Radiant Capital gets a $53M haircut. Thought multi-sigs were safe? Think again. Radiant's "robust" 3/11 setup crumbled like a house of cards. Exploited twice in 2024, the future of Radiant looks about as bright as a black hole.